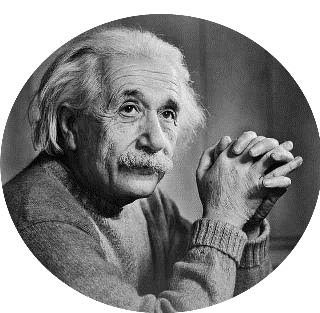

One of the most popular quotes that I have come across on my path to financial freedom is, Compounding interested is the 8th wonder of the world - Albert Einstein. Apparently, there is no evidence to prove that he actually said it, but who cares, it's true!

This is how I understand and define compounding interest. (Disclaimer: Feel free to google the definition and find all kinds of different ways of explaining it, most more technical than my layman version here. This is how it makes sense in my head). There is also a great book called The Power Curve: Smart Investing Using Dividends, Options, and the Magic of Compounding. In it, he talks about the magic of compounding.

Compounding interest is when you have an investment that gains interest. This interest is then reinvested with the original amount and as a result, the combined amount is now gaining interest. As time goes by and this reinvesting keeps happening, your investment grows exponentially.

Lets look at my current 401k investment. I have a whooping $10,000 currently in my 401k, and i'm getting about a 7% annual return on it. What will I have in 30 years? Not enough, but I plan to fix that, as soon as I get out of debt!

I will have $76,122.

How did I get there? The formula goes like this:

Present Value x (1 + interest rate) to the n-th power (years) = Future Value OR

PV x (1 + r) n = FV

So...

$10,000 x (1+.07) to the 30th power = $76,122

Compounding interest is key to understanding your investment to time relationship. The longer you wait to invest and save the less time you allow for the 8th wonder of the world, compounding interest, to work for you! When I crunched the numbers on my own finances it was a bit hard to swallow some of the financial choices I made in my 20s, but beginning now is better than never starting at all!

Things to think about

*Compounding interest and how it helps you in your investments.

*Run the numbers on my investments. Where will I be in 10, 20, 30 years at the current rate? Where will I be if I make monthly contributions to my current investment in 10, 20, 30 years? Where will I be if I increase my monthly contributions by $100 in 10, 20, 30 years?

Have you done the math on your investments yet? Are you contributing enough to get to your investment goals?

Send me a message. Did you love the post or hate it? What would you like the next topic to be? Follow me on Twitter @financegirl

Send me a message. Did you love the post or hate it? What would you like the next topic to be? Follow me on Twitter @financegirl

No comments:

Post a Comment